W O R K I N G P A P E R S

Patents, News, and Business Cycles 💾

R&R at the Review of Economic Studies

Silvia Miranda-Agrippino, Sinem Hacioglu Hoke, and Kristina Bluwstein (2018) CEPR Discussion Paper n. 15062 (Previously: When Creativity Strikes: News Shocks and Business Cycles)

✏️ Revised July 2022

MEDIA 📰 Great Expectations: the economic power of news about the future

ABSTRACT We exploit information in patent applications to construct an instrumental variable for the identification of technology news shocks that relaxes all the identifying assumptions traditionally used in the literature. The instrument recovers news shocks that have no effect on aggregate productivity in the short-run, but are a significant driver of its trend component. News shocks prompt a broad-based business cycle expansion in anticipation of the future increase in TFP, but only account for a modest share of fluctuations in macroeconomic aggregates at business cycle frequencies. The stock market prices-in news shocks on impact but consumer expectations, dragged down by labor market outcomes, take sensibly longer to adjust, consistent with the predictions of models of information frictions.

Bayesian Local Projections 💾

R&R at the Review of Economics and Statistics

Silvia Miranda-Agrippino, Giovanni Ricco (2021) Warwick Economics Research Papers No: 1348

✏️ Revised April 2021

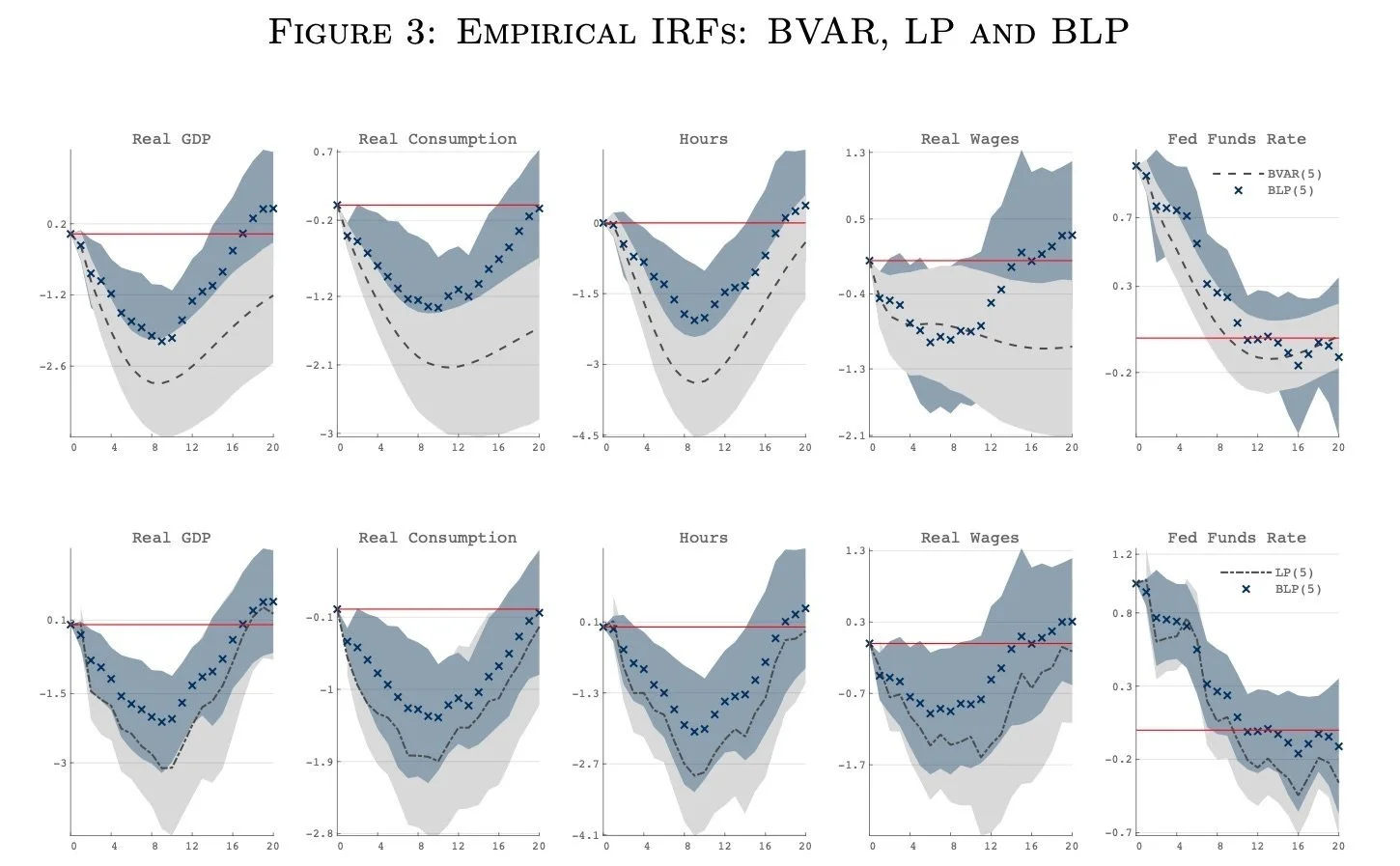

ABSTRACT We propose a Bayesian approach to Local Projections that optimally addresses the empirical bias-variance tradeoff inherent in the choice between VARs and LPs. Bayesian Local Projections (BLP) regularise the LP regression models by using informative priors, thus estimating impulse response functions potentially better able to capture the properties of the data as compared to iterative VARs. In doing so, BLP preserve the flexibility of LPs to empirical model misspecifications while retaining a degree of estimation uncertainty comparable to a Bayesian VAR with standard macroeconomic priors. As a regularised direct forecast, this framework is also a valuable alternative to BVARs for multivariate out-of-sample projections.

Global Footprints of Monetary Policies 💾

Silvia Miranda-Agrippino, Tsvetelina Nenova and Hélène Rey (2020), Centre for Macroeconomics, Discussion Paper n. 2020-04

✏️ First Draft January 2020

ABSTRACT We study the international transmission of the monetary policy of the two world’s giants: China and the US. From East to West, the channels of global transmission differ markedly. US monetary policy shocks affect the global economy primarily through their effects on integrated financial markets, global asset prices, and capital flows. EMEs in particular see both a reduction in inflows and a surge in outflows when the market tide turns as a result of a US monetary contraction. Conversely, international trade, commodity prices and global value chains are the main channels through which Chinese monetary policy transmits worldwide. AEs with a strong manufacturing sector are particularly sensitive to these disturbances.

Unsurprising Shocks: Information, Premia, and the Monetary Transmission 💾

Silvia Miranda-Agrippino (2016) Bank of England, Working Paper n. 626

✏️ Revised August 2017

> > D O W N L O A D R E P L I C A T I O N F I L E S < <

MEDIA 📰 The surprise in monetary surprises: a Tale of Two Shocks (Bank Underground Blog) 📰 Wall Street Journal Pro Central Banking

ABSTRACT This article studies the information content of monetary surprises, i.e. the reactions of financial markets to monetary policy announcements. We find that monetary surprises are predictable by past information, and can incorporate anticipatory effects. Surprises are decomposed into monetary policy shocks, forecast updates, and time-varying risk premia, all of which can change following the announcements. Hence, their use as identification devices is not warranted, and can have strong qualitative and quantitative implications for the estimated responses of variables to the shocks. We develop new measures for monetary policy shocks, independent of central banks’ forecasts and unpredictable by past information.

Nowcasting China

Domenico Giannone, Silvia Miranda-Agrippino and Michele Modugno, 2013

MEDIA 🎥 Interview at CIRANO Montréal

ABSTRACT In this paper we construct a synthetic indicator to monitor and summarise the informational content of the Chinese macroeconomic data flow. The index is optimally extracted in real-time from a heterogeneous set of dat, published at different frequencies and in a non-synchronous fashion, that we select to best represent the Chinese economy. We evaluate the forecasting ability of the index in nowcasting Chinese real GDP in real time. We find that the forecast implied by our index are at least as accurate as market forecasts and outperform forecasts implied by other existing indices. Furthermore, our index-based forecasts are continuously updated and thus timelier than forecasts implied by other existing indices or produced by international institutions, including the IMF and the OECD.